The US is already at war with Russia and China and not necessarily well placed for victory. While Ukraine claims most of the media attention for having gone kinetic, economic relations are unrecognizable as anything other than warfare. US actions against Russia following their military intervention, including oil sanctions, banning from the SWIFT financial transactions system, and clearly coordinated corporate pullouts, are as severe as any America has brought against a foreign government. They also follow the hostile patterns of domestic cultural ‘cancellations’, making the most basic functions of economic life impossible. The problem for the US is that it is no longer in a position to level such draconian measures against a major global power. Unlike any time in the past three decades, China is positioned as a feasible alternative to America in the realms of global currency, production capacity, debt leverage, technological infrastructure, and the military muscle to back up their interests. To survive, American business and policy leaders must give the implications of this dynamic serious consideration.

Two recent events in the economic war demonstrate the decline of US dominance and the potential for once safe punitive actions to backfire: the ban of Russian oil imports and the banning of Russia from the SWIFT global financial settlements system. Both of these actions are likely to do more damage to the US Dollar (USD) than to the Russian economy in the long run. While Russia is the world’s third largest oil exporter, China accounts for nearly half of sales with the US serving as a largely insignificant market. The post-sanctions crude oil price spikes will therefore likely increase Russia’s oil revenues while only fueling inflation in the US.

The west’s decision to ban Russian banks from using the SWIFT system for global financial transactions is even more potentially damaging. This move has made it difficult for Russians to transact with international financial institutions and was apparently aimed at hindering the liquidity of Putin’s foreign reserves. This financial weapon may not be as potent as the west might hope however, and China has quickly filled the gap by offering its own international settlement platform, called CIPS. To further reduce American influence, Russia has decreased its USD reserves in favor of Chinese Yuan, from 40% in 2017 to 16% today. With US-Russia trade essentially eliminated, China has positioned itself as the dominant trading partner, reserve currency, and financial infrastructure provider for nations facing US sanctions.

This might be why OPEC countries are suddenly considering abandoning the ‘Petrodollar’ standard and pricing some oil transactions in Chinese Yuan. If the USD loses its status as sole currency with which to purchase oil, it will quickly lose its appeal as the global reserve currency of choice. That on top of the fact that 80% of M1 dollars ever printed were printed in the last two years, leaves the end of USD hegemony looking like a foregone conclusion. Maybe this is why Saudi and Emirati leaders have reportedly declined calls from the Biden administration as they negotiate trade terms with China: they see a new global master.

The highly publicized supply chain disruptions faced by the US during and since the COVID pandemic have done nothing to lessen the perception of US dependence. While shortages were a worldwide phenomenon, America faced its largest challenges in securing the supply of products produced in East Asia. It has become abundantly clear since early 2020 that the US is dependent on China, and nations within China’s sphere of influence, for everything from household supplies to complex electronics and high-tech components. If China were to impose sanctions on the US (or vis-a-versa), the economic damage could immediately dwarf anything stemming from the Ukraine-Russia conflict. If China were to exercise its military might to restrict supply from surrounding countries, the US economy would likely collapse in short order. This is increasingly a realistic threat considering recent events in eastern Europe and America’s apparent inability to prevent the outbreak of major warfare.

To much of the world, America’s power and influence must look to be rapidly collapsing, with China strongly positioned as an alternative. America’s vanishing dominance over global reserve currencies, financial infrastructure, economic productivity, and ability to enforce her interests through hard power is clearly on display. If the USD collapses, America’s financial leverage is also likely to diminish accordingly. China has stepped up to replace US hegemony in each of these areas and is poised to dominate much of the world in debt leverage through infrastructure loans made under their Belt and Road Initiative. The challenge for American policy makers and corporations is now to accept the reality of this new power dynamic and begin adapting to it. Reshoring critical production capabilities, focusing investment on countries in the US sphere of influence, and sobering monetary and financial policy are essential next steps. Without serious recognition of the new playing field and its economic implications, American business and policy leaders could be walking off a cliff.

If you enjoy these articles, please subscribe for free!

I had a conversation with a Venezuelan refugee the other day and he shared some valuable insights on how societal collapse really plays out. And here are some thoughts on the implications.

Follow me at my new channel, InfoNarco, on YouTube since they’ve been blocking me from posting recently. I’ll see how long that can stay up.

The rest of the stories on YouTube:

Article links:

https://www.flgov.com/2022/08/18/governor-desantis-announces-the-arrest-of-20-elections-criminals/

https://www.eugyppius.com/p/exhaustive-study-of-german-mortality?triedSigningIn=true

https://www.covid19treatmentguidelines.nih.gov/therapies/antiviral-therapy/ivermectin/

The enormous expansion of the IRS and recent Trump raid are a different kind of tyranny than the cancel culture prison of the last decade. But there are still ways of fighting back.

Share this information. We have to start defending our towns and our states while we still can.

As you’ve probably already seen, the FBI just raided Trump’s home in Mar a Lago. Totally unprecedented in the US. Could you imagine if the Clintons were raided for fraud, murder, or wtfe happened at Epstein’s island? Or Bush for murder of 3k Americans on 9/11, insider trading, or…. genocide? Obama? The federal government’s strategy is being clear now. It’s full on police state, using law enforcement to suppress opposition. That’s why they are bringing on 87k new IRS agents. I think it’s time for states to start protecting their citizens from a hostile and illegitimate force in DC. Idk where else it’s worth putting forward any political energy. DC is lost.

Interested to here what you guys think. Feels like we are going into a new phase of things.

https://www.revolver.news/2022/08/fbi-raids-mar-a-lago-breaking-trump-statement/

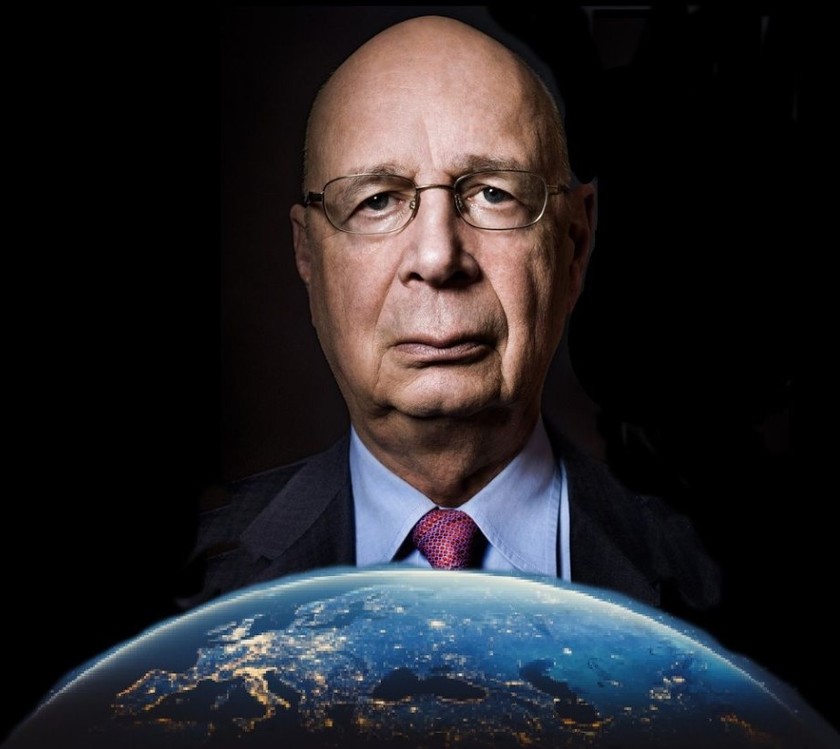

You have probably heard of the World Economic Forum’s ‘Great Reset’ initiative, their diabolically named scheme to transform the global economic, social, and governance system into something Mussolini would have immediately recognized as fascism. Or fascism without even a nod to any of its more admirable traits. The goal of the ‘Great Reset’ is to create a borderless global society based on collaboration between ‘stakeholders’ (as defined by the WEF, naturally) and a web of ‘public-private partnerships’ – or in layman’s terms, state-corporate corruption. This will of course necessitate the abandonment of outdated notions such as the nation state, individual liberty, and equality under the law, and isn’t likely to be too popular once the masses catch on. But don’t worry, the WEF knows you won’t be happy. To grease the skids for the new global totalitarianism, the jackasses of Davos have compiled a suite of tools and technologies necessary for controlling 8 billion people.

At this point, you ...

Remember when all those US manufacturing jobs were offshored to cheap labor markets like China, Mexico, and Vietnam, leaving millions of blue-collar Americans without options or useful skills? Remember how they were supposed to learn to code? Well, the same thing is now happening to white collar jobs – including those who code.

After the huge wave of industrial offshoring that followed the end of the Cold War, Americans were told by their politicians and talking heads that they’d be left with a ‘service economy’ – and that this was a good thing. We would get cheap goods from overseas which we’d be able to afford by way of a strong dollar and our employment in work requiring a more cerebral or personal touch. This left much of the US workforce in corporate services roles like HR, IT, accounting, finance, procurement, market intelligence, data analysis, etc. With English language, educational, and deep technical requirements, these jobs were presumably safe. Not anymore.

Today, the corporate services ...