Blockchain hasn’t emerged as the revolutionary solution for trust-related and multi-party record keeping problems that enthusiasts have predicted for years, despite countless whitepapers, proofs-of-concept, rebrandings (i.e. multi-party systems, distributed ledger, etc.), and purportedly useful crypto projects. As of this writing, the only widespread practical uses for blockchain remain cryptocurrency and non-fungible tokens (NFTs), neither of which have found much use as enterprise or real world solutions. Unlike these more niche retail usages, large-scale enterprise applications come with unique challenges, the main hurdles being that it is much more difficult to accurately capture real world information for most use cases and that blockchain doesn’t offer sufficient advantages to the early participants needed to build the critical mass that makes the tool beneficial. More simply, these are problems of bridging the physical to digital gap and lack of incentives for early participation.

Both problems have many layers of complexity within them, but I’ll stick to the main obstacles and broad stroke example of how they might be overcome.

The digital to physical gap

The gap between the theoretical and practical possibilities of blockchain is the primary practical stumbling block I’ve come across in discussions with clients and colleagues. While blockchain is a great tool for ensuring the authenticity of historical records, it can’t do anything to ensure the authenticity of what is entered into the record. If real world events are not accurately captured, the blockchain can become an immutable history of inaccuracy or simple fraud. Human error, the messiness of business in the physical world, and human propensity for deceit often result in documentation discrepancies which must be reconciled whether recorded on a blockchain or traditional systems. This means a useful blockchain must reflect real world events with near perfect accuracy.

As an example how blockchain currently fall short for enterprise use consider the widely promoted idea of using smart contracts to automate procurement. The purchase-to-pay process (ordering something through paying supplier) exists to verify what was ordered is what was delivered before making a payment, essentially establishing trust. This is theoretically a great blockchain application. The problem is that most of the manual work is caused by human error in recording the receipt of goods or completion of services. Since this receipting process is very difficult to automate for many categories, smart contracts currently have very limited applicability.

To solve for this complication, companies must focus on accurately automating the physical receipting process before blockchain could be technically feasible. Solutions generally fall into the realm of the ‘internet of things’ (IoT), with tools such as RFID chipping, geofences, drone or remote monitoring technology, etc. The same logic applies to any other use case where the capture of transactions is more complex than sending and receiving value (i.e. cryptocurrency). From this perspective, blockchain is better viewed as a potential tool to be brought into play further down a purpose-driven technology roadmap. Whether or not technical gaps are surmountable, there is still a more fundamental question: Is there a reason for multiple parties to participate in a multi-party ecosystem?

Incentives for participation

Blockchain is sometimes referred to as a ‘multi-party’ solution because the value of the tool is derived from many different parties, who do not trust each other, using the blockchain as a single source of truth. It has the potential to deliver many benefits if properly implemented across a whole ecosystem, but with a catch. A large proportion of participants must adopt the tool for any use case to be feasible and value is dependent on the number and importance of the parties participating. Without general acceptance of a blockchain solution as the standard, most companies view it as an additional complication, cost, and risk. They would still need to maintain their own records for dealings with non-participating parties, likely have to pay a ‘node’ hosting fee, lose direct control of on-chain data, and in many cases open themselves up to undesirable levels of transactional transparency. One example of this challenge is from a real-world scenario in the automotive industry.

Automotive original equipment manufacturers (OEMs), such as Ford or Toyota, often negotiate pricing for certain components with suppliers several tiers upstream in the supply chain. This is called a Directed Buy Agreement, or DBA, and is a product of the unusual amount of buying power OEMs have within their industry. Given this level of control, using blockchain to track DBA pricing compliance across multiple tiers of suppliers could eliminate an enormous amount of tedious reconciliation work for the OEM. The problem is that suppliers have little incentive to agree to such transparency. Total and automated transparency could eliminate any and all flexibility, result in more rebates or credits to the OEM, subject them to an additional cost for maintaining a ‘node’, and raise concerns that competitors might gain access to their pricing or suppliers through a relatively untested technology solution.

There are a few possible ways to break through the incentive barrier for this or any other use case: 1) requirements for blockchain use could be brought down from on-high by governmental or regulatory mandate, 2) industry consortiums could set blockchain related standards for specific use cases, 3) companies with outsized market power could make participation a condition of doing business, or 4) practical blockchain solutions could arise organically from the consumer market. The consortium route (scenario two) or participation as a condition of being selected as a supplier for a new vehicle program (scenario three) could be appropriate for the example above. The top-down scenario is playing out in other spheres today, as many governmental organizations are exploring blockchain tools as digital identity and currency solutions. Organic growth has also shown some promise with the growing acceptance of NFTs tied to digital art or digital gaming assets, which may at some point become the most convenient platform for tokenizing certain types of enterprise level assets. Each of these scenarios is likely to play out, depending on use case.

Conclusion

Overall, blockchain has great promise to simplify the enterprise technology landscape, increase transparency, reduce opportunity for fraud, and decentralize control of information. It also carries heavy risks for abuse if mandated by unaccountable governments or parties with regulatory powers. In either case, the physical world which is much messier than the 1s and 0s of the digital world, and the blockchain must accurately reflect the former. If we want to reap the benefits and avoid the dystopian dangers of blockchain technology, we must first understand the outcome we are seeking and consider whether this tool can and should be the means of getting there. If the answer to both these questions is yes, then blockchain may be a tool to consider as part of a strategic roadmap.

I had a conversation with a Venezuelan refugee the other day and he shared some valuable insights on how societal collapse really plays out. And here are some thoughts on the implications.

Follow me at my new channel, InfoNarco, on YouTube since they’ve been blocking me from posting recently. I’ll see how long that can stay up.

The rest of the stories on YouTube:

Article links:

https://www.flgov.com/2022/08/18/governor-desantis-announces-the-arrest-of-20-elections-criminals/

https://www.eugyppius.com/p/exhaustive-study-of-german-mortality?triedSigningIn=true

https://www.covid19treatmentguidelines.nih.gov/therapies/antiviral-therapy/ivermectin/

The enormous expansion of the IRS and recent Trump raid are a different kind of tyranny than the cancel culture prison of the last decade. But there are still ways of fighting back.

Share this information. We have to start defending our towns and our states while we still can.

As you’ve probably already seen, the FBI just raided Trump’s home in Mar a Lago. Totally unprecedented in the US. Could you imagine if the Clintons were raided for fraud, murder, or wtfe happened at Epstein’s island? Or Bush for murder of 3k Americans on 9/11, insider trading, or…. genocide? Obama? The federal government’s strategy is being clear now. It’s full on police state, using law enforcement to suppress opposition. That’s why they are bringing on 87k new IRS agents. I think it’s time for states to start protecting their citizens from a hostile and illegitimate force in DC. Idk where else it’s worth putting forward any political energy. DC is lost.

Interested to here what you guys think. Feels like we are going into a new phase of things.

https://www.revolver.news/2022/08/fbi-raids-mar-a-lago-breaking-trump-statement/

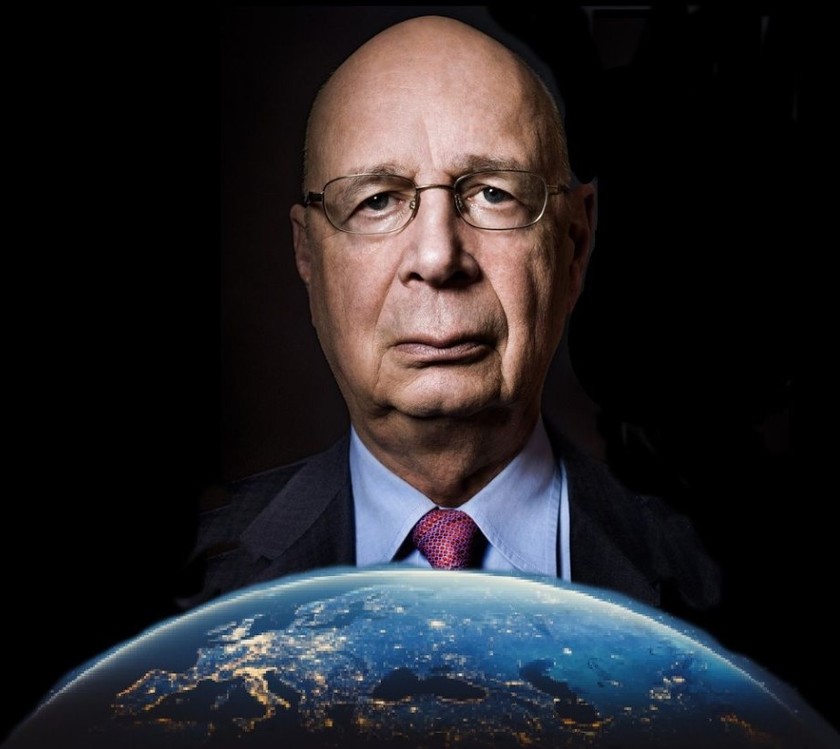

You have probably heard of the World Economic Forum’s ‘Great Reset’ initiative, their diabolically named scheme to transform the global economic, social, and governance system into something Mussolini would have immediately recognized as fascism. Or fascism without even a nod to any of its more admirable traits. The goal of the ‘Great Reset’ is to create a borderless global society based on collaboration between ‘stakeholders’ (as defined by the WEF, naturally) and a web of ‘public-private partnerships’ – or in layman’s terms, state-corporate corruption. This will of course necessitate the abandonment of outdated notions such as the nation state, individual liberty, and equality under the law, and isn’t likely to be too popular once the masses catch on. But don’t worry, the WEF knows you won’t be happy. To grease the skids for the new global totalitarianism, the jackasses of Davos have compiled a suite of tools and technologies necessary for controlling 8 billion people.

At this point, you ...

Remember when all those US manufacturing jobs were offshored to cheap labor markets like China, Mexico, and Vietnam, leaving millions of blue-collar Americans without options or useful skills? Remember how they were supposed to learn to code? Well, the same thing is now happening to white collar jobs – including those who code.

After the huge wave of industrial offshoring that followed the end of the Cold War, Americans were told by their politicians and talking heads that they’d be left with a ‘service economy’ – and that this was a good thing. We would get cheap goods from overseas which we’d be able to afford by way of a strong dollar and our employment in work requiring a more cerebral or personal touch. This left much of the US workforce in corporate services roles like HR, IT, accounting, finance, procurement, market intelligence, data analysis, etc. With English language, educational, and deep technical requirements, these jobs were presumably safe. Not anymore.

Today, the corporate services ...