You’ve probably heard the term ‘fractional reserve banking’ but chances are you don’t know what it is. And if you don’t know what it is, you obviously can’t understand its implications. Maybe that’s the point of its bland, too-many-syllables, corporate ring. But the fact is fractional reserve banking is the biggest and most successful scam ever devised, it underlies our economic system, and it’s made modern prosperity possible – it’s also what will likely bring it down.

Money is created in two ways in our system. It is either ‘printed’ by the Federal Reserve (in cash or digital form) or it is created by private banks in the form of credit, or loans. When the Fed prints money it is either spent on a government program or lent to private banks at a certain interest rate (which is what you hear being talked about as interest rates in the news). Banks can then create money out of thin air when they extend loans to consumers and businesses under the condition that they hold a fraction of the value of the loan in reserve in the form of Fed printed cash. This is what fractional reserve banking means. Banks must hold a small fraction in reserve of the trillions of dollars they create from nothing and earn interest on.

In modern times, you cannot tell the difference between money created by the bank or that printed by the Federal Reserve because you typically only see money as 1s and 0s on a computer screen. It appears to be entirely accessible to you and not some form of IOU. But that’s exactly what most of it is. Simple IOUs.

To simplify the concept and its origins, imagine a wealthy businessman in Renaissance Venice who had learned the black art of accounting. He now made his money by storing gold for merchants and wealthy citizens who couldn’t risk holding so much valuable metal themselves, loaned small portions of it out to credit worthy citizens to finance their ventures, and charges extremely high interest rates to compensate him for the risk of not being paid back. When debtors couldn’t pay him back, he would have to chase him down for his money, break some kneecaps, and try to sell their collateral to compensate for his loss. If his depositors (the people who stored their gold with him) wanted their gold back, he was pretty certain to have it available. The problem was that collecting interest, his real business, was high effort and risky.

At some point this guy figured out that he held so much gold, nobody doubted that they would be able to get their deposits back from him when needed. He also realized that gold is inconvenient and risky to carry. So he decided offer paper contracts, in lieu of physical gold, with the expectation that whomever had possession of the contract could exchange it for gold at any time. This worked out great for everyone. The paper was light and easy to carry, it was accepted by merchants who knew it could be converted to gold, and everyone’s real gold was safely locked up in the businessman’s vault. This was more or less the first form of paper money and technically the first derivative (the contract was derived from gold). So long as the businessman was honest, there was little risk to his depositors.

But the lending was still high effort and risky for the businessman because he had to make sure he got back every ounce of gold he lent out, plus interest, to make a profit. So, he came up with a very simple and clever solution. Since people rarely asked for their actual gold back, he simply began writing contracts for more gold than he actually had and charged interest on his contracts as he always had. He was getting paid for just handing out paper!

Nobody was the wiser and people took his paper fully confident it could be exchanged for gold. They could still trade it with others as they had before, just like gold. But in reality, the new banker was running an enormous scam. To illustrate the scale of such a potential con, let’s say he stored 500 lbs of gold in his vault. In his new scheme, he decided to write contracts worth 20,000 lbs of gold, against which he charged interest, which continued to be exchanged in the local market with the understanding that they were as ‘good as gold’. The people holding his paper had no idea how many contracts the banker has created or how much gold he actually had available, but they believe that if there were 20,000 lbs of gold in contracts floating around, there must be 20,000 lbs of gold in a vault. Which of course, there wasn’t.

Now there was a new risk for this banker (or con artist). If every person holding a contract came to the banker one day and demanded the gold promised by their pieces of paper (totally 20,000 lbs of promised gold), he wouldn’t be able to deliver. He only has a small fraction in reserve – 500 lbs. Luckily for him, this rarely happened. But every once in a while, it does. This is called a ‘bank run’.

When some panic finally set in and the locals made a run on the bank, you can imagine how the banker might find himself in a bit of trouble. Hordes of angry merchants had just discovered they’ve sold their valuable goods for worthless paper with his name on it and wealthy leading citizens had just learned their fortunes had been stolen! Maybe it was at this point that the outrage of the king’s wealthy supporters and the unrest in the streets forced the king to intervene.

The kingdom’s wealth and economy rested now on this credit scheme, the king’s supporters required that it continued to salvage their fortunes, and why shouldn’t the royals get in on such a lucrative scam themselves! The king had the means to store gold securely for depositors, even more so than the banker. If the king were to issue paper contracts, he could also reap the phenomenal rewards of fractional reserve lending, all while having the personal security of his army and the prestige of the state to underly the perceived value of his paper money. But the risk of a bank run remained and putting down an angry crowd of defrauded subjects and nobles might have been a bit too unseemly for the monarch or cost him the more nuanced political capital he needed to remain in power. So, he decides to get in on the game with a little more plausible deniability.

The king came to the rescue of all. He declared that the state had all the gold needed to cover the banker’s notes and would issue state paper own (backed by state gold, of course) to the banker to pay his angry contract holders. Now that the bank paper was backed by state paper and presumably by state gold, everyone was satisfied and goes about their business. The prestige of the state would convince the people that all the paper had value and the king would require that the banker hold enough of the royal currency to pay back anyone holding the banker’s paper. The state had saved the day and the money scheme has taken on a new dimension.

The banker was now the middleman. The king could engage in the same game of lending to the banker (with a fraction of gold actually in reserve) and the banker lent his own paper to the people while holding a fraction of his loans in the king’s currency in reserve. The next time the banker got himself in trouble, the king would simply bail him out by printing more currency. Since the system was so obscured from the public at this point, nobody complained and the currency was generally considered sound.

The new currency systems was essentially on a gold standard but essentially detached from gold itself. This new dynamic opened up the possibilities of even more financial derivatives like company stocks, traded on the stock market. These assets were valued in units of currency (their expected sales value in the stock market) but no new currency, let alone gold, actually existed as these stocks gained value. As the public mind associated money less and less with the existence of physical gold, it occurred to governments that there may be no need to hold a fraction of circulating currency in reserve as gold at all. And so, the United States abandoned the gold standard in 1933 in order to increase the amount of money in circulation during the Great Depression. Monetary policy was now simply a matter of printing and setting interest rates for banks.

The result was free-floating fiat currency. It was tied to nothing and was no longer even a derivative of a physical gold. In the case of the US dollar, some measures were taken to stabilize the currency such as ensuring oil could only be purchased in dollars (a similar concept to tying it to gold), but in reality the dollar’s value was backed by nothing more than the confidence in and influence of the US government. There was nothing to stop the Fed, and the banks who own it, from creating any amount of money out of thin air. And increasingly, that’s exactly what they have done right up to the present day.

Now consider that the Federal Reserve is a private institution. Congress just appoints directors. Now consider those directors come from the private banking industry that ‘borrows’ from the Fed. And imagine that these same people know exactly when new money will be created and can use it to buy property with real world value before anyone else realizes the money has lost value. And imagine how they might be able to bail themselves out every time their scheme gets out of hand by simply lending those banks whatever money they need for free.

Probably nothing to see here.

I had a conversation with a Venezuelan refugee the other day and he shared some valuable insights on how societal collapse really plays out. And here are some thoughts on the implications.

Follow me at my new channel, InfoNarco, on YouTube since they’ve been blocking me from posting recently. I’ll see how long that can stay up.

The rest of the stories on YouTube:

Article links:

https://www.flgov.com/2022/08/18/governor-desantis-announces-the-arrest-of-20-elections-criminals/

https://www.eugyppius.com/p/exhaustive-study-of-german-mortality?triedSigningIn=true

https://www.covid19treatmentguidelines.nih.gov/therapies/antiviral-therapy/ivermectin/

The enormous expansion of the IRS and recent Trump raid are a different kind of tyranny than the cancel culture prison of the last decade. But there are still ways of fighting back.

Share this information. We have to start defending our towns and our states while we still can.

As you’ve probably already seen, the FBI just raided Trump’s home in Mar a Lago. Totally unprecedented in the US. Could you imagine if the Clintons were raided for fraud, murder, or wtfe happened at Epstein’s island? Or Bush for murder of 3k Americans on 9/11, insider trading, or…. genocide? Obama? The federal government’s strategy is being clear now. It’s full on police state, using law enforcement to suppress opposition. That’s why they are bringing on 87k new IRS agents. I think it’s time for states to start protecting their citizens from a hostile and illegitimate force in DC. Idk where else it’s worth putting forward any political energy. DC is lost.

Interested to here what you guys think. Feels like we are going into a new phase of things.

https://www.revolver.news/2022/08/fbi-raids-mar-a-lago-breaking-trump-statement/

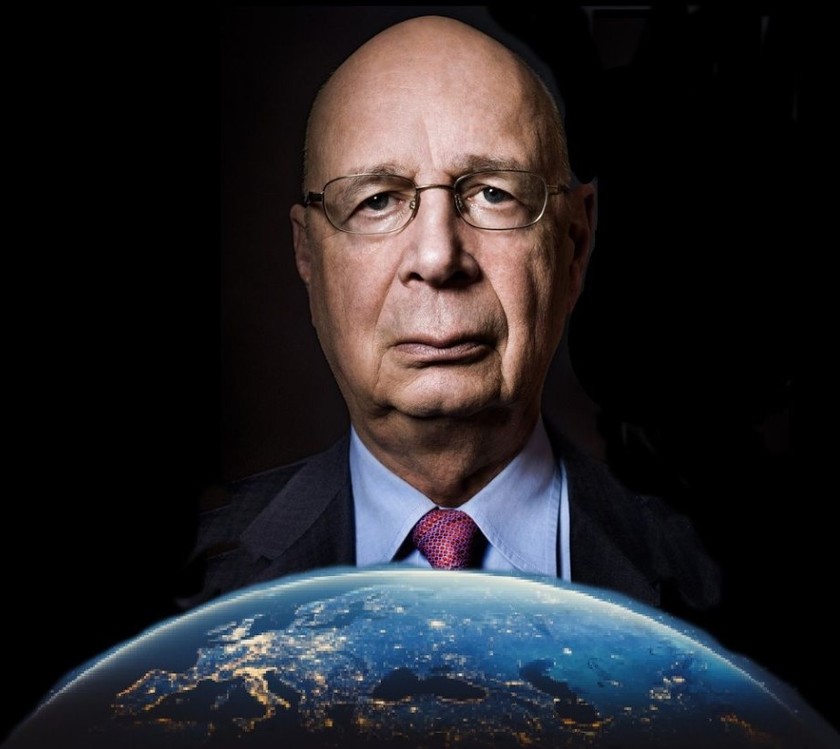

You have probably heard of the World Economic Forum’s ‘Great Reset’ initiative, their diabolically named scheme to transform the global economic, social, and governance system into something Mussolini would have immediately recognized as fascism. Or fascism without even a nod to any of its more admirable traits. The goal of the ‘Great Reset’ is to create a borderless global society based on collaboration between ‘stakeholders’ (as defined by the WEF, naturally) and a web of ‘public-private partnerships’ – or in layman’s terms, state-corporate corruption. This will of course necessitate the abandonment of outdated notions such as the nation state, individual liberty, and equality under the law, and isn’t likely to be too popular once the masses catch on. But don’t worry, the WEF knows you won’t be happy. To grease the skids for the new global totalitarianism, the jackasses of Davos have compiled a suite of tools and technologies necessary for controlling 8 billion people.

At this point, you ...

Remember when all those US manufacturing jobs were offshored to cheap labor markets like China, Mexico, and Vietnam, leaving millions of blue-collar Americans without options or useful skills? Remember how they were supposed to learn to code? Well, the same thing is now happening to white collar jobs – including those who code.

After the huge wave of industrial offshoring that followed the end of the Cold War, Americans were told by their politicians and talking heads that they’d be left with a ‘service economy’ – and that this was a good thing. We would get cheap goods from overseas which we’d be able to afford by way of a strong dollar and our employment in work requiring a more cerebral or personal touch. This left much of the US workforce in corporate services roles like HR, IT, accounting, finance, procurement, market intelligence, data analysis, etc. With English language, educational, and deep technical requirements, these jobs were presumably safe. Not anymore.

Today, the corporate services ...